Learn more about personal and business finance by reading any one of our insightful blogs.

Assets: A Revolutionary Approach to Personal and Business Finances

Are you tired of feeling uncertain about your financial future? Do you lie awake at night wondering if you’re saving enough, investing wisely, or simply letting money slip through your fingers? What if there was a way to not only understand your finances but to take complete control of them—without chasing risky investments or guessing your way to retirement? At Root Assets, we’re revolutionizing the way people approach personal and business finances with our groundbreaking Personal Economic Model® (PEM) and a client-centered philosophy that puts you in the driver’s seat of your financial destiny.

Why Root Assets Stands Out

In a financial world obsessed with chasing the next big stock or high-risk opportunity, Root Assets takes a smarter, more grounded approach: we help you find and reclaim money you’re losing unknowingly and unnecessarily. Instead of gambling on speculative wins, we focus on plugging the leaks in your financial bucket—because keeping more of what you earn is the foundation of true wealth.

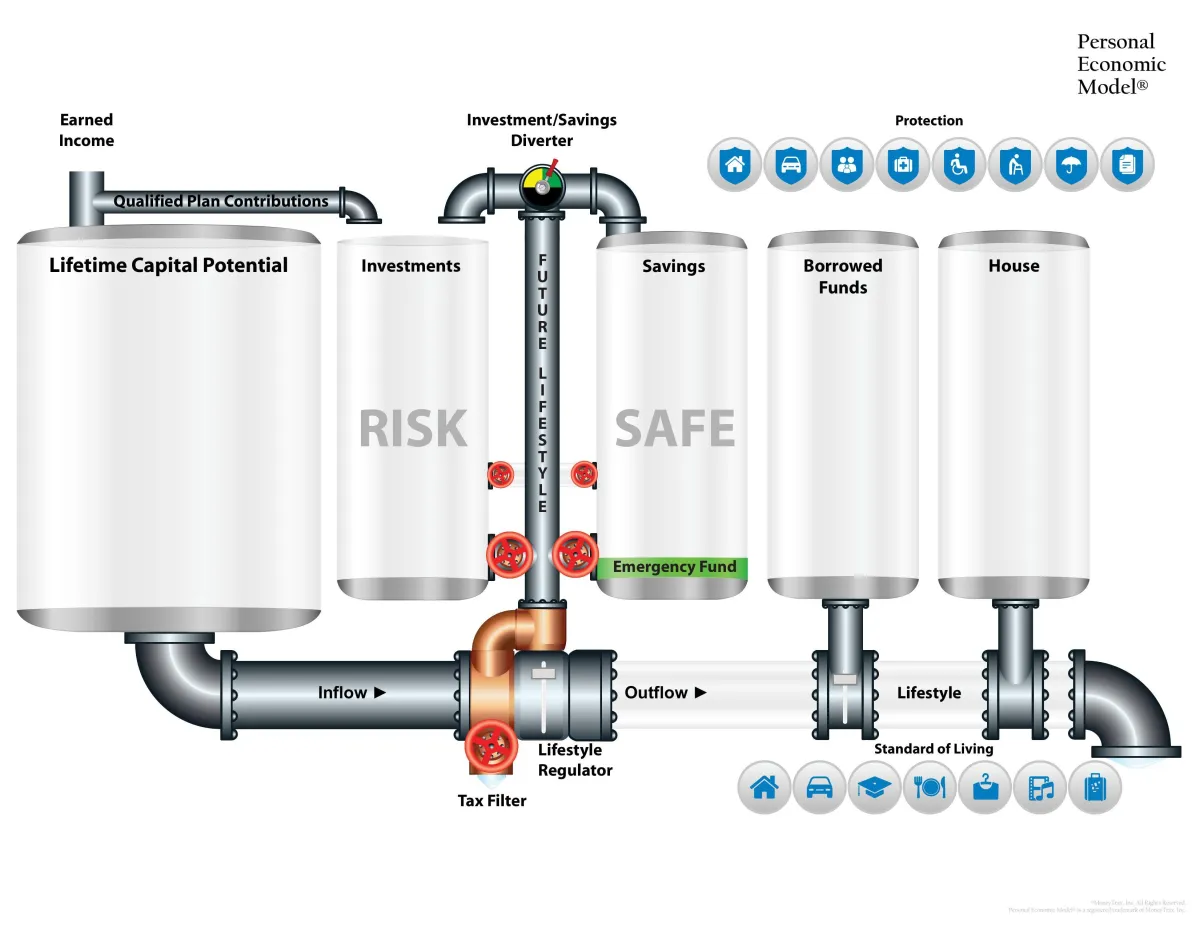

Our secret weapon? The Personal Economic Model® (PEM)—a visual, interactive tool that transforms the complexity of finance into a clear roadmap. It breaks your money into three powerful categories:

Accumulated Money: Your savings and investments for the future.

Lifestyle Money: What you spend to enjoy life today.

Transferred Money: The dollars slipping away through taxes, debt, and poor planning.

The PEM doesn’t stop there. It pinpoints six key areas where most people lose money without realizing it:

Mortgages

Taxes

Retirement Accounts

Education Expenses

Major Purchases (like cars or vacations)

Insurance Structures(How your insurances are set up)

Imagine seeing exactly where your hard-earned dollars are going—and learning how to redirect them toward your goals. That’s the clarity Root Assets delivers.

A Visual Roadmap to Financial Freedom

Picture this: a world where you know:

What rate of return you need to retire comfortably at your current standard of living.

How much you need to save each month to secure your future.

How long you’ll need to work before you can retire with confidence.

How to avoid downgrading your lifestyle in retirement.

The PEM makes this a reality. It’s not just a theory—it’s a hands-on tool that shows how your income flows through taxes, lifestyle expenses, and savings, and how these choices shape your future. With interactive features like the Lifetime Capital Potential tool, you’ll see the staggering amount of money that will pass through your hands over your career—and how taxes, debt, and spending can erode it. More importantly, you’ll discover how to protect it.

For example:

The Lifestyle Regulator acts like a financial GPS, balancing your current desires with your future needs. It answers the four most critical questions that determine if your plan is on track.

The Tax Filter History reveals how taxes have impacted wealth over time—and how to minimize their bite on your savings.

Whether you’re building wealth in your accumulation years or preserving it in retirement, the PEM adapts to your life stage, giving you confidence at every step.

Education and Empowerment, Rooted in You

At Root Assets, we believe knowledge is power. That’s why our website is packed with interactive resources that make complex financial concepts simple and actionable. Dive into topics like:

The history of taxes and their long-term impact.

The power of compounding interest versus the pitfalls of speculation.

Strategic asset allocation for risk, taxation, and accessibility.

These aren’t just tools—they’re eye-openers. They let you see your finances in a whole new light, empowering you to make informed decisions with real-time insights.

And you’re never alone on this journey. Our advisors are ready to guide you. In just 15 minutes over coffee, they can answer those four pivotal questions that unlock your financial future:

What rate of return do you need to maintain your lifestyle in retirement?

How much do you need to save each month?

How long will you need to work?

How can you avoid reducing your standard of living in retirement?

These aren’t guesses—they’re personalized, actionable answers tailored to your life.

Take Control Today

Don’t let your hard-earned money vanish into the black hole of poor planning. Root Assets isn’t just about managing wealth—it’s about maximizing it. Our approach ensures you’re not just surviving financially but thriving, with a plan built to last through your life expectancy.

Ready to stop wondering and start knowing? Visit rootassets.com today to explore the PEM, dive into our interactive tools, and connect with an advisor who can help you chart your path to financial freedom. Your prosperity is our priority—and it’s just a click away.

Take the first step toward a secure future. Visit Root Assets now!